Education Budget - CalEdFacts

This content is part of California Department of Education's information and media guide about education in the State of California. For similar information on other topics, visit the full CalEdFacts.This information is current as of November 2014. Up-to-date information on the state and federal education budgets is available on the California Department of Education (CDE) budget page.

On June 20, 2014, the Governor signed the 2014 Budget Act and related trailer bills, putting into place a spending plan for 2014–15 and a revised spending plan for 2013–14.

The 2014 Budget Act reflects a continued improvement in the state’s finances. The spending plan continues to reduce the “wall of debt” the state had accumulated after years of deficits and begins to reinvest in the state’s core educational services, while also promoting savings through a rainy day fund. The 2014–15 budget package projects General Fund (GF) resources of $109.4 billion and GF expenditures of $108 billion, with an estimated $1.4 billion reserve at the end of 2014–15.

GF expenditures for K–12 and child development programs are $45.3 billion and total funding for K–12 education, including state, local and federal funds, is $76.6 billion.

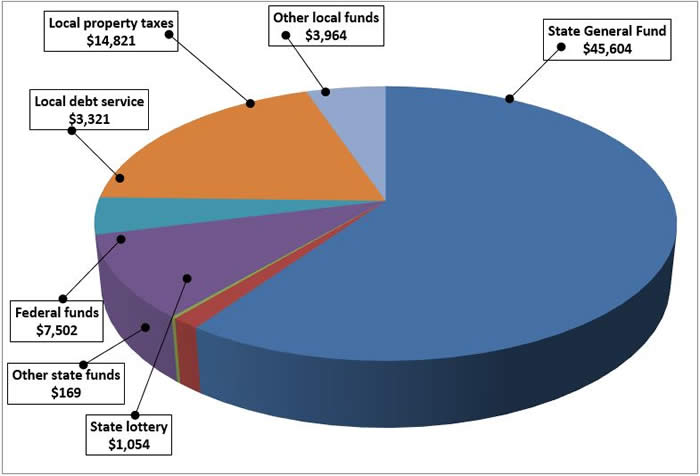

The pie chart below shows 2014–15 K–12 funding sources and amounts..

Sources and Funding for K–12 Education in 2014–15 (in millions)

Major components of the 2014–15 kindergarten through grade twelve (K–12), child development (K–12 education), and community college education budgets are described below.

Proposition 98 Changes

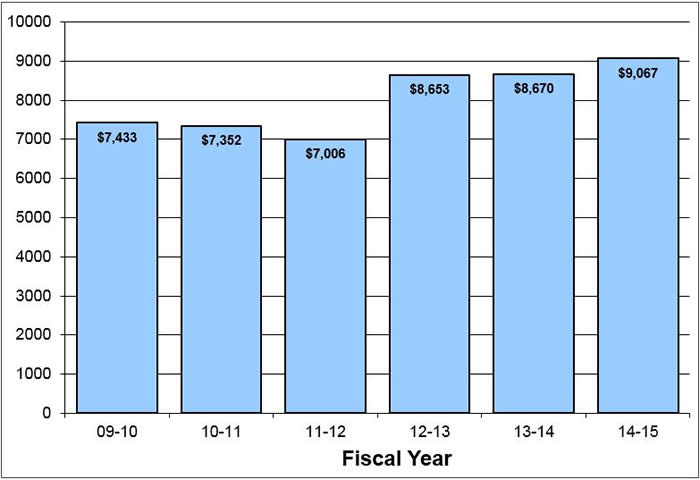

The budget package includes a Proposition 98 funding level of $60.9 billion for K–12 education and community colleges in 2014–15, an increase of $2.6 billion over the 2013–14 revised budget level. For K–12 only, Proposition 98 funding is $54.2 billion, an increase of $2.3 billion over the 2013–14 revised budget level. As the chart below shows, K–12 per-pupil funding of $9,067 per Average Daily Attendance (ADA) in 2014–15 is a significant improvement in Proposition 98 funding levels, especially when compared to the $7,006 per ADA provided in 2011–12.

The budget package also makes significant revisions to the 2013–14 education budget. It reflects Proposition 98 funding of $58.3 billion for K–12 and community colleges (K–14) in 2013–14, an increase of $3 billion over the 2013 Budget Act. For K–12 only, Proposition 98 funding is $51.9 billion, an increase of $2.7 billion over the 2013 Budget Act. The K–12 funding level represents funding of $8,670 per unit of K–12 ADA in 2013–14.

Proposition 98 Per-Pupil Funding, 2009–10 through 2014–15 (in thousands)

Local Control Funding Formula

The Department of Finance originally projected that an eight-year phase-in period would be needed to fully fund the Local Control Funding Formula (LCFF). The 2014 Budget Act remains on track to achieve that objective, providing $4.75 billion to support the second year of implementation of the LCFF. The Department of Finance estimates that this increase will close 29.56 percent of the remaining gap for school districts and charter schools and will fully fund the LCFF for county offices of education.

Deferrals

The budget package eliminates K–12 intra-year deferrals and provides $4.7 billion to reduce K–12 inter-year deferrals, leaving a remaining deferral balance of $897 million at the end of the 2014–15 fiscal year. In addition, the budget package includes a “trigger” to pay down the remaining K–12 deferral obligations if GF revenues exceed budget projections.

Career Pathways Trust Program

The budget package includes $250 million to support a second cohort of competitive grants. The Career Pathways Trust was initially authorized in the 2013 Budget Act and provides grant awards to improve career technical programs and linkages between employers, schools, and community colleges.

Rainy Day Fund and Reserve Requirements

On November 4, 2014, voters approved a measure to establish a new rainy day fund to replace the existing Budget Stabilization Account. The approved measure will:

- Require deposits into the fund based on GF revenues and the portion of GF revenues attributed to capital gains taxes.

- Require paying down state debt and liabilities as the reserve accumulates, subject to limits on withdrawals.

- Limit the balance in the fund to 10 percent of GF revenues.

- Establish a Proposition 98 reserve. Deposits would not be made to this account until the current maintenance factor obligation is fully paid off.

The budget package modifies current law as it relates to ending fund balances for school districts. First, beginning in 2015–16, a school district that proposes to adopt or revise a budget that includes an ending fund balance that is two to three times higher than the state’s minimum recommended amount must substantiate the need for the higher balance.

Second, in a year immediately following a deposit into the Proposition 98 reserve, a school district’s adopted or revised budget may not contain an ending fund balance higher than two to three times higher than the state’s minimum recommended amount, depending on the school district’s ADA. A county superintendent may waive the prohibition, pursuant to specified conditions, for up to two consecutive years within a three-year period.Independent Study

The budget package changes some of the procedures associated with independent study programs.

The budget also streamlines the existing independent study program and creates a new “course based” independent study option for grades K–12 beginning in 2015-16. The new option will allow entire courses, instead of individual assignments, to be converted into instructional time.

Mandates and Common Core

The budget package provides $400.5 million in one-time funds to be allocated on a per ADA basis to local educational agencies (LEAs). The funds would first satisfy any outstanding K–12 education mandate claims. Language in the budget expresses legislative intent for LEAs to prioritize the use of the funds for activities related to the implementation of Common Core State Standards including professional development, instructional materials, and technology infrastructure.Child Development/Early Education

The budget begins to restore the cuts that have been made to early learning programs over the past several years, with a total of $150 million for California State Preschool (CSPP) and $100 million for General Child Care and Alternative Payment Programs.

California State Preschool Program

The budget package provides:

- $29 million for 7,500 part-day slots effective July 1, 2014, and $1 million for 4,000 part-day CSPP slots effective June 15, 2015.

- $38 million for 7,500 General Child Care wrap-around slots for the CSPP effective July 1, 2014, and $2 million for 4,000 effective June 15, 2015.

- $10 million for transfer into the Child Care Facilities Revolving Fund to be used for renovation or repair of existing LEA facilities, or for new relocatable child care facilities for lease to LEAs that provide CSPP.

- $25 million for professional learning.

- $50 million for Quality Rating and Improvement System (QRIS) block grants for support of local early learning quality rating and improvement systems.

- $25 million to increase the part-day standard reimbursement rate by 5 percent.

- $15 million to backfill fee revenue lost as a result of repeal of the family fee for part-day preschool.

Finally, the budget allows CSPP providers to retain an additional 10 percent in their reserve funds for purposes of professional learning for CSPP staff.

Transitional Kindergarten

The budget package aligns the transitional kindergarten curriculum to the California Preschool Learning Foundations that were developed by the CDE, and phases in new requirements for transitional kindergarten teachers. After July 1, 2015, new transitional kindergarten teachers will be required to have a credential from the Commission on Teacher Credentialing and by August 2020 have additional specified qualifications.

General Child Care and Alternative Payment Programs

The budget package provides:

- $4 million for 500 Alternative Payment slots.

- $13 million for 1,000 General Child Care slots.

- $24 million to increase the standard reimbursement rate by 5 percent.

- $12.8 million, effective January 1, 2015, to increase the regional market rate ceiling to the 85th percentile of the 2009 market rate survey and then deficit the amount by 13 percent.

High Speed Network

The budget provides $26.7 million to support network connectivity infrastructure grants and completion of a report on network connectivity infrastructure. Priority for grants would go to the LEAs that are unable to administer computer-based assessments at the school site.

California Clean Energy Jobs Act (Proposition 39)

Due to lower-than-anticipated revenues, the budget reduces Proposition 39 allocations from $363 million in the Governor’s Budget to $316.5 million ($279 million for K–12 education and $37.5 million for community college districts) for improvement of energy efficiency and the creation of clean energy jobs. Additionally, the budget continues to fund the Energy Conservation Assistance Act revolving loan program with $28 million set aside for that purpose.

Facilities

The budget includes language that shifts the remaining fund balance from incentive grants to promote designs and materials used in high-performance schools and the Career Technical Facilities Program to other specified purposes, including new construction and modernization of school facilities and seismic repair, reconstruction, or replacement. This provision takes effect on January 1, 2015. In addition, the Office of Public School Construction is required to complete a report regarding efforts to streamline and speed up the award of seismic mitigation funds.

The budget also includes $188.1 million for the Emergency Repair Program to provide grants or reimbursements to LEAs for repairs or replacement of building systems.

California State Teachers Retirement System

The budget package begins to address the California State Teachers Retirement System (CalSTRS) current unfunded liability. Absent corrective action, CalSTRS was projected to exhaust pension resources in 33 years. The budget package increases pension contributions from all three entities currently responsible for CalSTRS contributions: the state, LEAs, and teachers. New contributions in the first year are modest, totaling about $275 million. The contributions will increase in subsequent years, reaching more than $5 billion annually. Total contributions will rise from 19.3 percent of teacher payroll to 35.7 percent of teacher payroll. The increased contributions are projected to eliminate the unfunded liability by 2046.